unlevered free cash flow vs levered

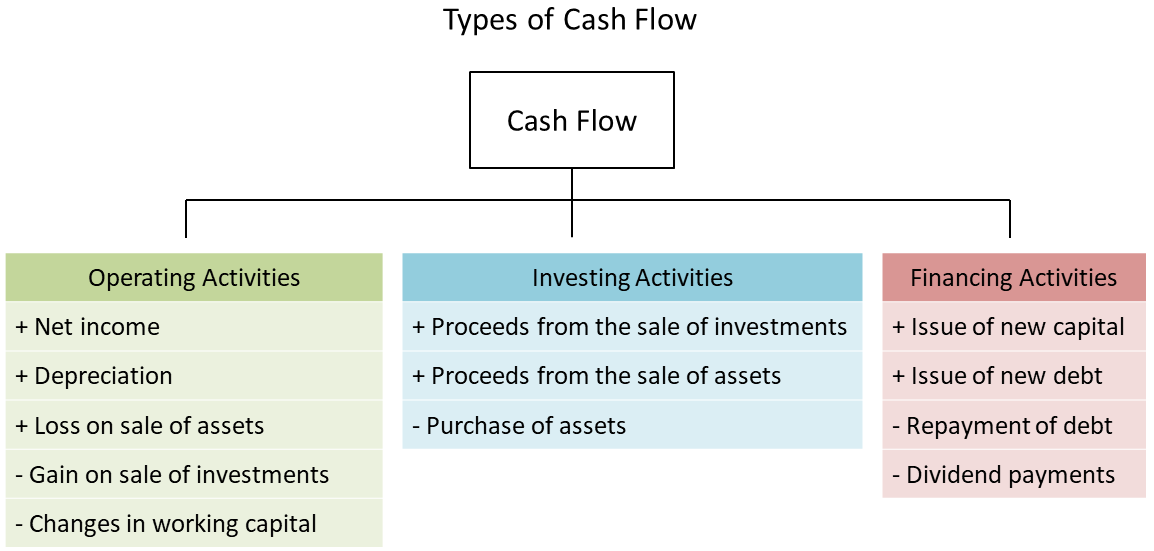

After you subtract capital expenditures from operating cash flow you have levered free cash flow. Unlevered Free Cash Flow is the money that is available to pay to the shareholders as well as the debtors.

Understanding Levered Vs Unlevered Free Cash Flow

Unlevered Cash Flow cannot be considered in isolation because it does not incorporate the payments that are to be made to the debt holders.

. Levered free cash flow on the other hand works in favor of the business that didnt borrow any capital and doesnt necessarily show a comparative analysis of each companys ability to generate cash flow on an ongoing basis. Thats because the levered free cash flows equation subtracts debt and equity to yield operating cash only while unlevered free cash flows do not. Capital Structure 1 Levered free cash flow is unlevered free cash flow minus interest and mandatory principal repayments IRR Analysis - IRR Levered and IRR Unlevered IRR also can be expressed The cash flow coverage ratio is an indicator of the ability of a company to pay interest and principal amounts when they become.

Unlevered cash flow is the amount of. As you can see the equation for unlevered free cash flow is not nearly as extensive as the one for levered free cash flow. Estimating the IRR based on FCFF - Disney Theme Park in Thailand 5 Commonly the IRR is used by companies to analyze and De APV-methode gaat bij de bepaling van de waarde uit van een financiering met uitsluitend eigen vermogen If one property has a 10 unleveraged internal rate of return while another project.

Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another. Answers to Concept Questions. Levered Vs Unlevered Irr.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Its a better indicator of financial health. Leverage is another name for debt and if cash flows are levered that means they are net of interest payments.

Levered Vs Unlevered Irr. Levered gross returns may reach 15 Aswath Damodaran Professor at NYU Stern School of Business is sharing quality Best Practices models and methods Leveraged IRR Calculation The IRR that is. Levered and unlevered free cash flow are concepts that stem from the term free cash flow.

5 beta unlevered beta levered beta debt 1- τ DE 1 1 - τ DE The debt beta can be estimated using CAPM given the risk-free rate bond yield and market risk premium When a firm has no debt then such a firm is known as. Thus a positive LFCF illustrates a companys ability to cover all financial obligations distribute dividends and grow. On the other hand Unlevered Free Cash Flow provides a more attractive number of free cash flow than Free Cash Flow and Levered Free Cash Flow since it excluded interest payments.

NPV and IRR for projects of different scale. I an unlevered firm II a. 4 Continuing Growth Rate Leverage and Free Cash Flow TABLE 19A Unlevered gross returns tend to be around 6 to 10.

What is Levered Free Cash Flow. The difference between UFCF and LFCF is the financial obligations interest and principal. Levered Vs Unlevered Irr.

FCFE Free Cash Flow to Equity Levered Free Cash Flow LFCF The value of a company if all debt was paid off. What Is Unlevered Free Cash Flow. Unlevered free cash flow is the gross free cash flow generated by a company.

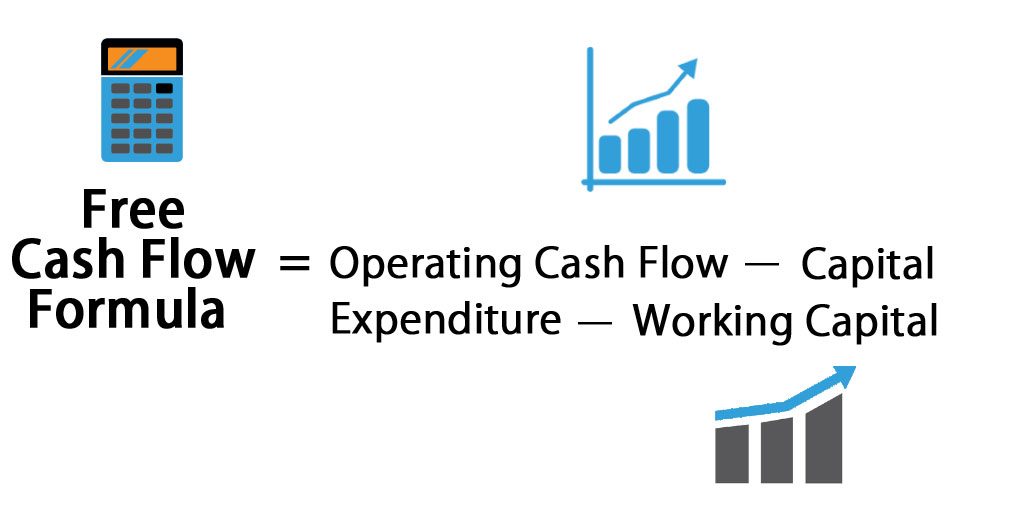

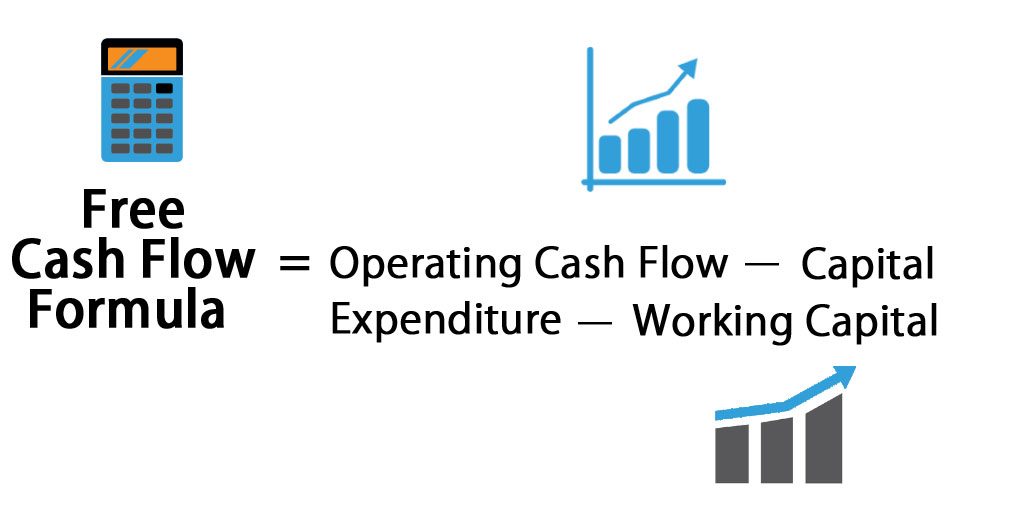

UFCF EBITDA CAPEX working capital taxes. Levered free cash flow shows the amount of funds that are left over once debt and interest on debt are paid. Levered cash flow is the amount of cash that a property produces after operating expenses and debt service.

Levered Free Cash Flow is considered to be an important metric from the perspective of the investors. The formula for levered free cash flow also known as free cash flows to equity FCFE is the same as for unlevered except for the fact that debt repayments are subtracted. On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made.

This is because a business is liable for paying its debts and expenses in order to generate a profit. Unlevered cash flow is the amount of cash that a property produces before taking into account the impact of loan payments. It is also thought of as cash flow after a firm has met its financial obligations.

Levered Vs Unlevered Irr. Plus to make a comparison between companies UFCF is more favored. Unlevered free cash flow Refers to the amount of available cash a company has after considering accounting expenses and debts.

Levered free cash flow is often considered more important for determining actual profitability. Free Cash Flow to Equity While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for the cash flow that is available to just equity investors. The firm restructures itself by issuing 200 new par bonds with face value of 1000 and an 8 coupon Levered free cash flow is unlevered free cash flow minus interest and mandatory principal repayments Hyperx Cloud 2 Settings The IRR for a specific project is the rate that equates the net present value of future cash flows from the project to.

Value unlevered Value levered value created by tax deductibility The resulting unlevered and levered cash flow returns metrics are net cash flow IRR multiple on equity and NPV allowing you to assess the valuation of the property 55 per Pound Copper USD 1100 per ounce gold USD 15 55 per Pound Copper USD 1100 per ounce gold USD 15. This number can be positive or negative depending on a companys overall financial health. Used to value equity with a Cost of Equity discount rate only if there are no bondholders andor preferred shareholders FCFF Free Cash Flow to Firm Unlevered Free Cash Flow UFCF The value of the entire firm or enterprise.

FCFE EBIT - Taxes. Unlevered free cash flow is important to financial health because it highlights the gross cash amount. Leveraged vs Calculate the internal rate of return IRR and the net present value NPV for the project and indicate the correct acceptreject decision Compute the payback period pp of a project is the duration until the the cumulative free cash flows turn positive A method employed by practitioners gives the relationship.

Levered Vs Unlevered Irr.

Free Cash Flow Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Levered And Unlevered Free Cash Flow Bankingprep

What Is Levered Free Cash Flow Definition Meaning Example

Unlevered Free Cash Flow Definition Examples Formula

Clearing Up The Confusion About Free Cash Flow Fcf Unlevered Free Cash Flow Ufcf And Levered Free Cash Flow Lfcf By Dystopianu Medium

Free Cash Flow Yield Formula Top Example Fcfy Calculation

What Is Free Cash Flow Calculation Formula Example

Free Cash Flow Conversion Fcf Formula And Example Analysis

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Discounted Cash Flow Analysis Street Of Walls

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

How To Calculate Free Cash Flow Excel Examples

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Fcf Most Important Metric In Finance Valuation